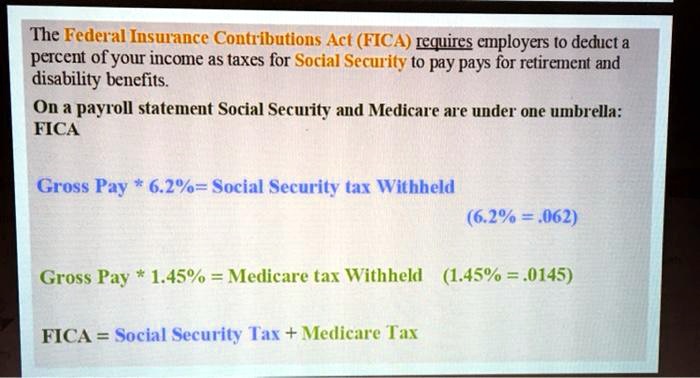

SOLVED: The Federal Insurance Contributions Act (FICA) requires employers to deduct a percentage of your income as taxes for Social Security to pay for retirement and disability benefits. On a payroll statement,

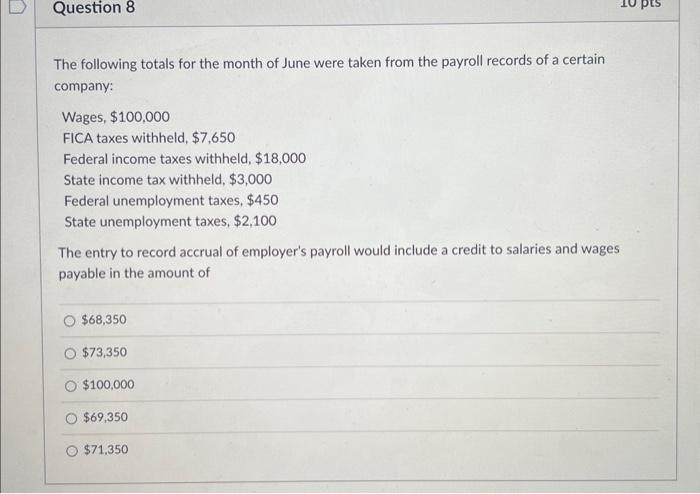

Solved: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 pa [algebra]

An employee earns $6,200 per month working for an employer. The FICA tax rate for Social Security is 6.2% - brainly.com

.jpeg)

:max_bytes(150000):strip_icc()/fica.asp_FINAL-428c1827d08648be803aea413ebacd15.png)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)